How to Become a Financial Adviser (or Planner): Empower People to Create Financial Freedom

A career as a financial adviser or planner is a genuine win-win. It’s your chance to help people improve their financial situation — while being well-rewarded for it. Sounds good? Let’s unpack how to meet the new requirements and become a financial advisor or planner in Australia.

Explore Financial Adviser Courses

How to become a financial adviser or planner

Especially for new financial planners, there are quite a few requirements to meet before you can be a qualified financial planner in the eyes of ASIC (Australian Securities and Investments Commission).

You can become a financial adviser or planner in Australia by:

Kristopher Meuwissen

Director, Founder and Principal Adviser, Wealtheon Financial Services

“Whilst the financial advice process can be complex, the simplest way to describe what I do is: I help people understand what is important in their lives and then put together financial strategies to help them accomplish those goals.

I’ve been in the industry for over ten years now, and when I started, I was one of the youngest advisers in the country.

The clear standout for me is when I first helped a client who was living week to week — and in tens of thousands of dollars in debt — to repay all outstanding creditors and build enough savings for them to be able to purchase their first home."

What is a financial adviser/financial planner?

Usually, the terms ‘financial advisor’ and ‘financial planner’ mean the same thing in Australia: a licenced professional who helps people set and achieve financial goals. They provide advice in budgeting, investing, superannuation, insurance, tax and retirement planning.

To call yourself a financial adviser or planner, you must be authorised (under an AFS licence) to provide personal financial advice on financial products. You must also be listed on the Financial Advisors Register and meet professional standards. These standards tightened after reforms in January 2019, following the Financial Services Royal Commission.

The professional standards require you to:

The following are not financial advisers:

Terms you’ll hear in the finance industry

Australian Financial Services (AFS) licence

The licence required to provide financial services in Australia, assessed by ASIC.

Financial Advisers Register

A list of professionals authorised as a financial adviser. View the Register.

AFS Licensees Register

A list of financial advisers (and businesses) with an AFS licence.

Authorised Representatives Register

A list of financial advisers working as authorised representatives of another’s AFS licence.

ASIC

Australian Securities and Investments Commission, an independent Australian Government body that regulates the financial services industry and the corporate, markets, and consumer credit sectors. ASIC is now the regulator for the financial services industry, taking FASEA’s place at the beginning of 2022.

How much do financial advisers get paid?

Salaries for financial planners tend to start at $70,000 in Australia, and the median is $119,964 — more than enough to build financial stability, especially if you apply what you’ve learned to your own finances.

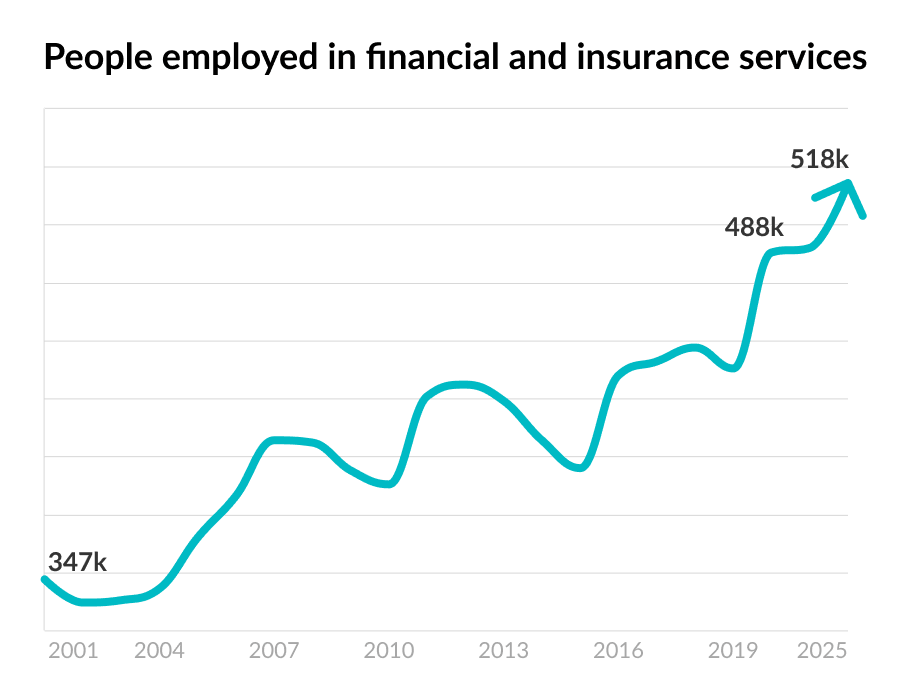

If you’re considering a financial advising career, your timing couldn’t be better. While the financial and insurance services industry is expanding fast, the new requirements have raised the barriers to entering (and staying) in the profession. Since the reforms, some financial planners had to gain a new qualification to continue working. These changes meant many left the profession, leaving a skills gap you can jump right into.

“There are massive opportunities for young people in this profession. We are shrinking as an industry even though demand is soaring for our services. We also get to build incredible, long term relationships with people and make a real difference in their lives.”

1. Get an approved financial adviser qualification

To meet the legal requirements for becoming a financial adviser or planner, you must study at an approved course at the bachelor level (AQF 7) or higher. View the list of approved courses.

Depending on your qualifications and experience, there are three pathways available:

Vocational pathway

If you don’t yet meet the entry requirements for a bachelor, consider using a vocational course as a pathway into higher education, such as:

Undergraduate

If you don’t have a degree yet, study an approved bachelor degree in accounting, business, mathematics, finance, economics, or financial planning. These can include:

Career changer

If you already have a degree, but it’s not on the list, you can study for an approved graduate diploma or masters. These can include:

If you hold an FChFP or ChLP designation from the AFA, this can count for credit towards the graduate diploma.

Diploma courses often lead into the second year of a bachelor degree. This isn’t always the case, so make sure you enquire with the provider first.

Planning to become a Certified Practicing Accountant (CPA) in addition to a financial adviser? You need to choose a degree in accounting from the approved list.

2. Complete a professional year

Your next step toward being fully qualified is to complete a professional year of supervised work and training. The professional year needs to be a full-time year (about 1600 hours), with 100 of those hours dedicated to structured training. During this time, you’ll be called a ‘new financial adviser’.

Throughout each quarter of the year, you’ll undertake a new key area of training:

Q1

Client observations and support to supervisor/experienced adviser

Q2

Supervised client engagement and advice preparation.

Q3 + Q4

Indirect supervision of client engagement and advice preparation

You can start this while you’re finishing up your degree, but before you start the third quarter you must have finished your degree and passed the exam. Once you’ve passed the exam, you can be known in the second half of the year as a ‘provisional relevant planner’.

Look for an entry-level position with a business that has an AFS licence, and is able to provide you with the necessary training.

“I believe that most of my skills were honed as a junior adviser, with supervision and direct mentorship from senior colleagues, over many years.”

What is Para-planning? Your Complete Guide

Para-planning jobs are an excellent place to start your financial planning career. These support roles allow you to learn the technical ropes before you start dealing with clients face-to-face. Find out what this entry-level financial planning role involves, including responsibilities, salary and industry statistics.

Read more

3. Pass the financial adviser exam

This compulsory exam set goes for 3.5 hours and consists of multiple-choice and written answer questions. The exam covers the following topics:

Requirements

Regulatory and legal requirements for financial advisers.

Financial advice construction

The suitability of advice aligned to different consumer groups, incorporating consumer behaviour and decision making.

Applied ethical and professional reasoning and communication

Incorporating the code of ethics and code monitoring bodies.

Source: ASIC

Professional standards for financial planners

Code of Ethics

The Code of Ethics framework is both a legal matter and a way to ensure client needs are at the forefront of all work. Twelve standards promote trustworthiness, competence, honesty, fairness and diligence. They can be found on ASIC’s website.

Continuing professional development (CPD)

Another part of maintaining financial planning standards is participating in 40 hours of professional development per year. This allows professionals to continue expanding their knowledge and skills.

The Changing Nature of Professional Financial Work

Discover how technology and data are disrupting the financial sector and what it means for future financial professionals.

Read more

4. Apply for certification (optional)

One of the most common and widely recommended certifications is the Certified Financial Planner (CFP). You’ll need to meet certain requirements before you get certified, including:

Education

To meet the education threshold, you must have a bachelor degree from an accredited university. You will then have to complete a list of financial planning courses in preparation for the exam.

The CFP exam

The CFP exam consists of a large variety of topics such as risk management, insurance, tax planning and estate planning, with 170 multiple choice questions in total. Not all questions are purely academic, however. Some address how you’ll develop rapport with your client and how you’ll go about collecting the information you need from them.

Work experience

To get certified, you’ll need to have three years of full-time work or two years of apprenticeship work. Also, keep in mind that the CFP board also does various background checks before they certify anyone. More information can be found on the CFP Board website.

Professional ethics

This involves agreeing to behave as a fiduciary, which means acting in the best interests of the client at all times when offering financial advice. You must also adhere to other high ethical and conduct standards set out by the CFP Board. You’ll have to give information about your background agree to a full background check.

Other certifications

It doesn’t stop there. You may choose to broaden or specialise your skillset in order to offer a wide range of services to your clients. Some other certifications you might look into include:

Fellow Chartered Financial Practitioner (FChFP)

A professional designation for both salaries and self-employed practitioners, from the Association of Financial Advisers (AFA) that helps you enhance your professional reputation and improve business outcomes. Equivalent to masters-level study.

Chartered Life Practitioner (ChLP)

A professional designation from the AFA for risk advisers looking for specialist recognition. Demonstrates commitment to professional development.

Certified Investment Management Analyst (CIMA)

A specialist international certification for professionals involved in constructing multi-manager, multi-asset portfolios.

Chartered Financial Analyst (CFA)

A highly-regarded certification for investment managers and analysts that qualifies you to work in senior and executive positions.

Certified Practising Accountants (CPA)

An internationally recognised certification from one of the world’s largest accounting bodies that develops your leadership, strategy and business skills.

5. Meet continuing professional development (CPD) requirements

Once you’re qualified, you need to keep up your continuing professional development (CPD) in order to keep your licence. CPD includes maintaining and extending your skillset, as well as ensuring you’re up-to-date with any changes in regulatory requirements and technical developments in the industry.

The requirements for CPD are:

"To further my skills, I have also taken many extra courses, like tax and commercial law, as well as mortgages and finance. I was awarded a graduate diploma in 2018. I am also looking for a university where I can undertake my Masters of Financial Planning."

Besides fulfilling the minimum requirements, lifelong learning is very much in your professional interest. If you’re looking to take your career to the next level, you’ll need to continuously upskill. A finance career could take you into the upper levels of strategy and business leadership — or launch you to the helm of your own business.

With the right training, the wide world of finance is at your fingertips.

Launching a Career in Financial Planning? Here’s What You Need to Know

Considering this career path? First, there are some things you should know so you’re set for success.

Start Here

Financial adviser FAQ

Browse Results

Diploma of Building and Construction (Building) (SE Melb Only) CPC50220

This course (CPC50220) is designed to meet the needs of people working in the building industry whose intention is to become a Registered Building Practitioner, satisfying the education requirements of the VBA. It is specifically designed for learners...

Certificate IV in Building and Construction (SE Melb Only) CPC40120

The Certificate IV in Building and Construction (CPC40120) is designed to meet the needs of people working in the building industry and who aim to be builders and managers of small to medium-sized building projects. This nationally recognised qualifica...

Diploma of Early Childhood Education and Care (VIC Only) CHC50121

The Diploma of Early Childhood Education and Care qualification reflects the role of educators in early childhood education and care who work in regulated children’s education and care services in Australia. Educators at this level are responsible for...

Certificate III in Individual Support (Disability) (VIC Only) CHC33021

Certificate III in Individual Support (CHC33021) qualification reflects the role of workers in the community and/or residential setting who follow an individualised plan to provide person-centred support to people who may require support due to ageing,...

Diploma of Nursing (SA Only) HLT54115

Build a career that’s meaningful, fills you with a sense of purpose, and provides diverse job opportunities, with this Diploma of Nursing course. Offered via a blend of on-campus and online learning the HLT54115 Diploma of Nursing is the ideal starting...

Certificate IV in Building and Construction (Building) (VIC Only) CPC40110

If you are an aspiring or working tradesperson, here is your foundation for success. This is your first step towards starting your own building business and preparing for the builders registration. We understand that you could be a busy tradie by day,...

Graduate Diploma in Management

The Graduate Diploma in Management is an online postgraduate qualification that is ideal for busy senior managers, with a potential entry pathway through any of our Graduate Certificates and study that is highly supported, fits into your schedule, and...

Graduate Certificate in Management

The Graduate Certificate in Management is an online postgraduate qualification that is designed for newer and ambitious professionals, with entry possible through management experience alone and a study structure that easily accommodates full-time work...

Diploma of Building and Construction (Building) (VIC Only) CPC50210

Prepare for registration as a Builder with the Diploma of Building and Construction (Building) (CPC50210) Gain the skills & knowledge to run your own business Study when it suits you – online & on campus options available...

Certificate IV in Plumbing and Services (VIC ONLY) CPC40912

This course covers common skills for the plumbing industry as well as specialist streams relevant to gasfitting, drainage, sewerage, roof drainage and more....

Building Leadership Programme (VIC ONLY) CPC40110 ,CPC502110

BAA is proudly partnered with Victoria University to offer our students higher education opportunities. Whether students are after an alternative way to gain entry into a degree, or simply want to try out a study path so they can confirm their longer-t...

Bachelor of Dance Education

Australia’s first Bachelor of Dance Education! Delivered through ACPE, this is a specialist professional qualification that is unique in Australia. Units are provided by highly qualified and experienced professionals, empowering you with all the knowle...

Bachelor of Education (Physical & Health Education)

If you’re keen to pursue a career in physical and health education, the Bachelor of Education (Physical and Health Education) will provide you with the graduate qualification to become a PDHPE teacher. Based on the Graduate Outcome Survey 2021, ACPE wa...

Associate Degree of Sport Business

Get a higher education qualification in two years when studying full-time! Based on the Bachelor of Sport Business in terms of content, the Associate Degree of Sport Business offers students the opportunity to get into the workforce quicker or alternat...

Bachelor of Dance Practice

The Bachelor of Dance Practice is a specialised degree that will equip you with the skills and experience to become a professional in the dance industry. The course develops artistry, choreography, performance, educational and organisational skills for...

Bachelor of Health Science (Exercise)

The Bachelor of Health Science (Exercise) offers the perfect career path for those looking to enhance their knowledge and skills through further studies in physiotherapy, exercise physiology, and other health professions. You will come to understand ho...

Bachelor of Sport Coaching (Strength and Conditioning)

To address the high demand for sport coaches and professionals in Australia, the Bachelor of Sport Coaching (Strength and Conditioning) is a specialist degree fostering the coaching, administrative, and professional skills necessary for a fulfilling ca...

Bachelor of Sport Coaching (Management)

With employment increasing in Australia for sport coaches and specialist managers, the future looks bright for our graduates. It doesn’t matter where your passion for sport takes you, your qualification from ACPE can help make your dream a reality. The...

Bachelor of Sport Business (Leadership)

Turn your passion for sport into a career by immersing yourself in a degree that will broaden your theoretical and technical knowledge, so that you are fully equipped fora management role within the sport industry. The Bachelor of Sport Business will d...

Certificate IV in Patisserie (Melbourne & Brisbane Only) SIT40721

This 18-month course combines practical and theoretical learning to give you expertise in all thing’s pastry. On this course you will learn everything from Gateaux to Croissants to Cheesecakes to Buffet showpieces. The role of a Chef Patisserie is a sp...